When are my forms due for submission?

To start, log into your account, click on the Submit Forms tab, and find your form that you are required to submit.

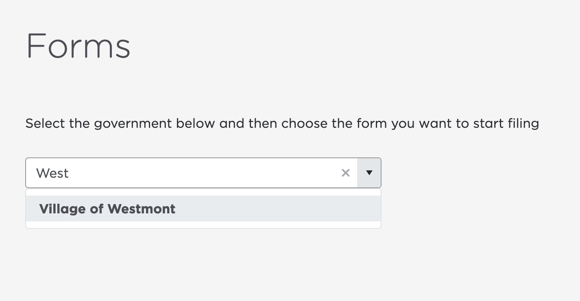

- Log into your Localgov account and click on the Submit Forms tab.

- Click on the name of the local government where you need to file a form.

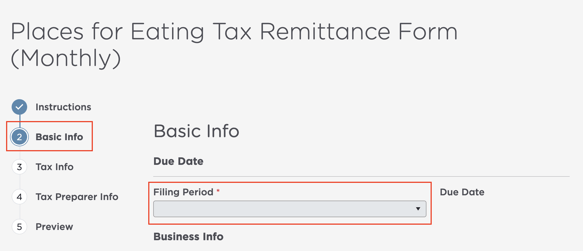

- Click on the name of the form for the tax or fee you need to pay.

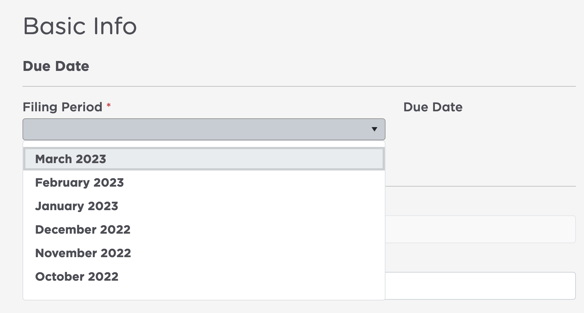

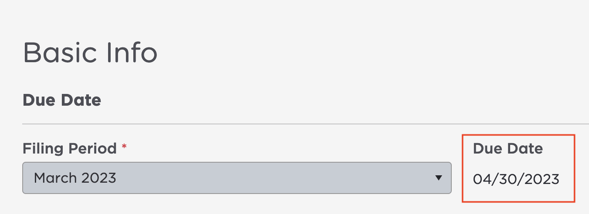

- On the first page or two of the form, you will see a drop-down for the filing period. Select the filing period you are filing the form for. Once you select the filing period, the form due date will appear.

- Every local government has different rules for their due dates. Some require filings to be submitted on the 20th of every month or the last day of the month. And some allow the due date to default to the next business day if it falls on a holiday or weekend, and others don't. You can usually read about form due dates on the first page of the form, where the instructions are. You can also give Localgov a call and we will answer all of your form questions!

If you need further assistance or have any questions, please contact Localgov Customer Service at (877) 842-3037 or email service@localgov.org.

![localgov-logo-white.png]](https://service.localgov.org/hs-fs/hubfs/localgov-logo-white.png?height=50&name=localgov-logo-white.png)